One of the most popular methods of investing is Value Investing. Among the various methods of investing, why is value investing the talk of the town? and how can we pick stocks for value investing? To answer questions like these, we have done a great deal of research and have filtered the most important points below.

This method was commenced by great investors Benjamin Graham and David Dodd. The method was first discussed in their book “Security Analysis” in 1934 and later in detail in the book “The Intelligent Investor“.

Table of Content:-

What is Value Investing?

Value Investing refers to investing in undervalued stocks in the market. To make the picture clearer, assume that you visit an electronic store to buy an air conditioner and be bewildered to find a huge discount on it. You buy it. You get an air conditioner with the same qualities but at less value! The same goes for the stocks. In value investing, an investor buys the stocks when they are at a discounted price.

Value investing works on three main principles:

1. Price and Stock Value are not the Same Things:

The intrinsic value of a stock is its underlying value that doesn’t depend on the market factors. It is calculated using fundamental and technical analysis. Whereas the market price is the price at which the stocks are being traded in the market. It gets affected by the demand and supply of stocks. In value investing, the stocks are bought when the stock price is less than the intrinsic value. Warren Buffett suggests buying the stocks at their intrinsic value and always maintaining a margin of safety. We’ll learn how to calculate the margin of safety in the latter half.

2. Consider the Changes in the Stock Market as an Opportunity:

The dwindling or rising prices of the stock market are considered a risk by investors. Still, value investing sees it as a favourable opportunity to buy the stocks when their stock value falls below the intrinsic value.

3. Stock Price Retains its Intrinsic Value in the Long Term:

The stock price keeps fluctuating around the intrinsic value. Whether the stock price is more than or less than the intrinsic value, it will retain its intrinsic value back in the long term.

How to Pick the Best-Valued Stocks?

Value investing, as we read, depends highly upon the intrinsic value of stocks. There can be instances when the fundamentals of the business do not change, but its stock prices can change due to some news that popped up about the business. Ideally, the fundamentals of the business that consist of the profit and loss statement, cash flow statement, and balance sheet are the same, but within a day, its prices have seen a fall. At this time, a value investor invests in the stocks of that company when the whole market fears buying that stock.

There may be a case when business circumstances might change, but its stock prices are still stagnant. For example, WIPRO experienced a change in the company’s management, but their prices shot up after 5 months. It was not immediately on the day of change in management the prices began to surge. While an ordinary investor might not consider investing in its stock at an earlier price but a value investor will gauge this stock as an undervalued stock and invest in it.

Investors hope to invest in stocks that are deeply undervalued but might generate profits in the future. Thus here we’ll look at some metrics that are used to gauge the intrinsic value of a stock and how YOU can select the best value stocks:

Discounted Cash Flow:

This is the most popular and the most basic method to calculate intrinsic value. It calculates the true value of an asset based on future earnings. For this method, you need three things:

- Estimate the future cash flows of the company

- Gauge the present value of each cash flow.

- Add up all the present values to get the intrinsic value of the asset.

To estimate future cash flows, you can have an exhaustive study of the financial statements and the cash flow statement to gauge its future cash flows.

Hold your horses as we’ve brought a formula using which you can calculate the intrinsic value of a company:

Intrinsic value = (CF1)/(1 + r)^1 + (CF2)/(1 + r)^2 + (CF3)/(1 + r)^3 + … + (CFn)/(1 + r)^n

where:

● CF1 is cash flow in year 1, CF2 is cash flow in year 2, and so on.

● r is the rate of return that you could get by investing that amount somewhere else.

If the intrinsic value of the stock comes to be more than the stock’s actual price, you can see that there’s room for profits. In the future, this company’s stock might catch momentum, and at that time, you can sell the shares at a price more than the intrinsic value.

Price to Earnings Ratio (P/E Ratio):

The P/E ratio is the amount of investment that an investor has to make in a company to get ₹1 of return. The companies with a high P/E ratio are more likely to demand higher investment in correlation to their earnings and might seem overvalued. Conversely, the companies with lower P/E ask for low investments relative to the earnings. However, the companies with a high P/E ratio might indicate that the company’s future prospects are strong and that the investors are willing to pay more in order to buy its stock.

Whether the stock is overvalued or undervalued depends upon the comparison of other stocks of the same industry.

You can calculate the Price to Earnings ratio using the following formula:

(How to Pick Stocks for Value Investing)

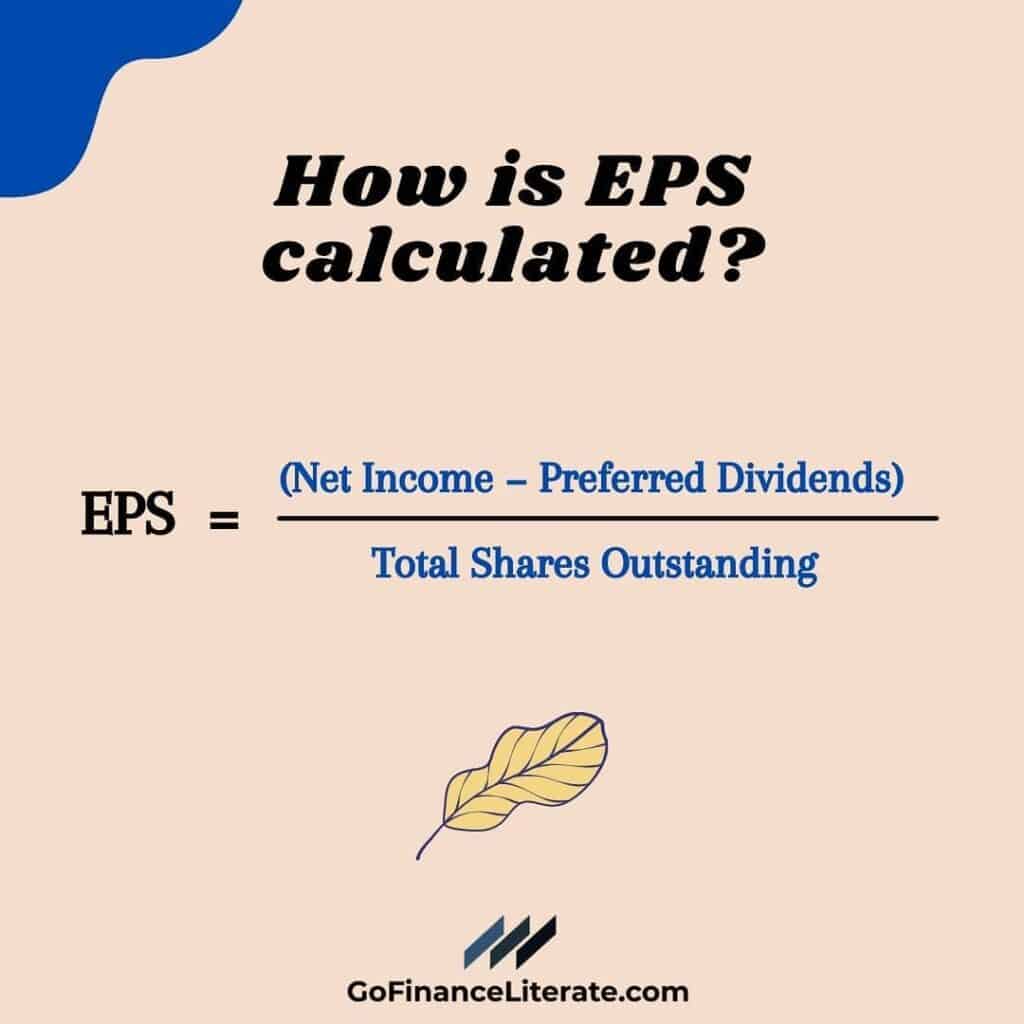

Now, you might be thinking about how to calculate the EPS of a stock. Don’t worry, we’ve got a formula for that as well:

(How to Pick Stocks for Value Investing)

To avoid risks, the value investor must stick to the company’s past earnings and look at the past profit trends.

Asset-Based Valuation:

The asset-based valuation simply presents the company’s value of assets after deducting the liabilities (both long-term and short term). For this, an investor must carefully look at the balance sheet of a company and compile all the assets and liabilities. This gives a fair picture of the company’s intrinsic value. However, this method can be a little misleading as it doesn’t consider the business’s future prospects, nor does it identify the intangible assets of the company like management, etc., which can play a huge role in determining the true intrinsic value of a stock.

This method is useful in comparing the stocks of companies whose liquidity position is sometimes hampered. This is a popular method that investors use in the real estate business. A company that can dispose of its liabilities by a good margin can be considered a good investing option.

Things to keep in mind while picking stocks for value investing:

1. Hard work and Determination

The value investing model requires an investor to determine the stock’s intrinsic value. This requires exhaustive calculations and following some methods like the ones mentioned above. Some other methods to evaluate intrinsic value are the dividend discount model, growth model, etc. Often, an investor might not be able to find an undervalued stock in the market, and in haste, he goes for an overvalued stock. It takes a lot of courage to buy an undervalued stock in the market when everybody else is selling that stock. Thus Value investing is a combination of patience, grit, determination, and courage.

2. Risk-taking Ability

Although value investing is relatively less risky, you must be ready to face the risk of losses. Many investors rely upon their calculations and evaluation of the financial statements of companies. This information must be the latest. Study the patterns carefully and look for the unexpected losses of that company. If the company faces huge unexpected losses at a recurring period, that company might be risky.

Conclusion

Warren Buffett rightly said that value investing is simple but not easy. Value investing abstains from the herd mentality. Instead, it asks you to determine the true value of the stocks. Investors tend to follow the crowd and purchase stocks when the prices are at a peak, and after a certain time when its prices start falling, they aren’t able to embrace the fall in prices of stocks and eventually sell the stocks at low prices. Value investing is all about purchasing a stock when undervalued and gauging the business’s future prospects, and diving into deeper details of the business. To spread your risks, invest in more than 10 different stocks to diversify your portfolio.