Let us look back at Union Budget 2021 and how it has affected prices of different commodities and what changes it has brought (or should I say ‘bought’). Finance minister Nirmala Sitharaman announced India’s first paperless budget this past week. As India’s finance had faced much disruption due to COVID-19, Finance Minister has presented the digital Union Budget for the year 2021 to repair, restore and rebuild India’s finances. The Union Budget 2021 is built around health, hope and growth.

Budget 2021 mainly targets six disciplines…

- Health and well-being

- Inclusive development for aspirational India

- Reinvigorating human capital expenditure

- Physical and financial capital and infrastructure

- Innovation and R&D

- Minimum government and maximum governance

Table of Content…

Key takeaways from Union Budget 2021

Under the Union Budget 2021, the spending on health and infrastructure has been increased substantially. The Union Budget has allocated over ₹2,83,000 crores for health and wellness to set up 30,000 rural and urban health centres. As the fight against COVID-19 continues, over ₹35,000 crores have been allocated for the COVID-19 vaccine which is enough to vaccinate over 175 crore citizens roughly.

Aatmanirbhar Bharat, with a budget of ₹27.1 lakh crores, aims to boost the capital expenditure, providing greater employment opportunities.

Infrastructure being a primary focus, the government has put forward many proposals in the budget such as offering public-private partnerships and privatization of many government sectors. Under the National Infrastructure Pipeline, the budget for public transport outlay has been raised to ₹18,000 crores. Deployment of Metrolite technologies in tier two cities has also been considered under this budget. A capital of ₹1.18 lakh crores has been allocated to build 11,000 km of the National highway corridor mainly in the states of Kerala, Tamil Nadu, West Bengal and Assam.

The proposal for the creation of seven mega textile parks over three years has been laid out. To make India a global hub for manufacturing and exports, the government has put forward the production linked incentive scheme on PLI for large scale electronic manufacturing.

The government’s capital expenditure for FY22 compared to last year is quite generous at around ₹5.54 lakh crores, with an increase of 35%. Over ₹1.1 lakh crores have been allocated to railways of which ₹1.07 lakh crores is for capital expenditure.

The proposed bill for the setup of Development Finance Institute as a professionally managed DFI is targeting a lending portfolio of 5 lakh crores in 3 years which is extremely important for infrastructure financing.

To generate energy from green sources, a budget has also been allocated to launch a comprehensive national hydrogen energy mission in the upcoming years.

Tax-related points from Union Budget 2021

- No change in direct taxes.

- Senior citizens above 75 exempted from filing Income Tax returns.

- Reduction in time for IT proceedings.

- No double taxation for NRIs with foreign retirement accounts.

- Tax audit limit increased from ₹5 crores to ₹10 crores.

- Startups get tax holiday for one more year.

Pros and Cons of Union Budget 2021

Pros-

- The Finance Minister seems to have considered the current situation of the nation, as a big figure has been allocated towards health and well being.

- Fiscal deposit for 2021 is pegged at 9.5% of GDP, 6.8% for the upcoming year 2022.

- FDI in Insurance has hiked up to 74% positive for HDFC life, SBI life and MAX life.

- A sharp increase in capex spending for ports, roads and infrastructure at 5.4 lakh crores with an additional 2 lakh crores to state capex.

- SENSEX has gone up by 9% this week, which is a positive sign from the investors.

- There is a fall in the prices of precious metals and base metals.

Cons-

- With a high capital allocated for health and wellness, spend on nutrition is down to 27% despite increased malnutrition among the rural and urban poor.

- The government has once again ignored the middle class in this budget.

- The poor and migrant labours have been affected as the government has cut down its allocation significantly on MGNAREGA scheme.

- The budget has focused on large scale cooperates but no significant change has been made for small businesses.

- The rise in Petrol and Diesel rates, considering that people are already suffering in terms of high petrol and diesel prices.

- Indirect taxes are very high.

- The outlay for agriculture is down by 6% which has brought the farmers on street for a huge market rally.

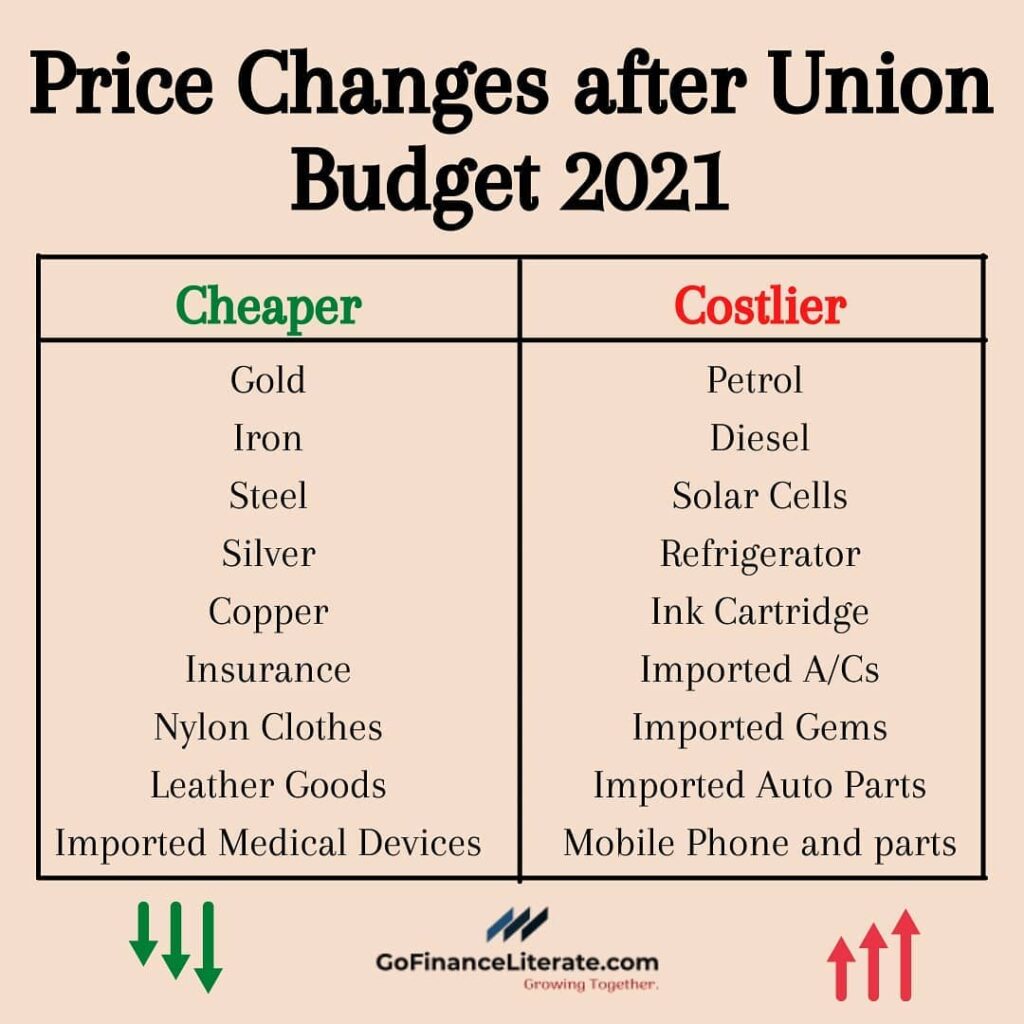

What got cheaper and costlier after the Union Budget?

Cheaper-

Here is a list of things that got cheaper

- Commodities: Gold, Silver, Iron, Steel, Copper, etc

- Insurance

- Nylon clothes

- Leather goods

- Imported medical devices

Costlier-

Here is a list of things that got costlier

- Petrol and Diesel

- Solar cells

- Refrigerator

- Imported Air Conditioners

- Ink Cartridges

- Imported gems

- Imported auto parts

- Mobile phones and parts

Want to know about money transfer methods within India (and other basic banking terms)? Head over to our post: https://gofinanceliterate.com/basics-of-indian-banking-system/

Looking for financial freedom? Read our post: https://gofinanceliterate.com/financial-freedom-through-financial-literacy/

If you’re looking for ways to receive payments from abroad, have a look at our post: https://gofinanceliterate.com/receive-international-payments-in-india/