Whether you are a 12 year old constantly hearing about these banking terms but not knowing what they actually mean, or a teen who’s looking forward to opening his/her bank account but don’t actually know about the terms related to Indian banking, or even a 20-something year old who has a bank account but doesn’t comprehend with the terms that go into the Indian banking system, this list is for all the people out there who just want to have a better understanding of the everyday banking terms in India.

Table of content…

- 1. Bank account number

- 2. Bank Passbook

- 3. Cheque

- 4. Indian Financial System Code (IFSC)

- 5. National Electronic Funds Transfer (NEFT)

- 6. Real Time Gross Settlement (RTGS)

- 7. Immediate Payment Service (IMPS)

- 8. Unified Payments Interface (UPI)

- 9. ATM Card

- 10. Debit Card

- 11. Credit Card

- 12. Loan

- 13. Interest

- 14. Collateral

- 15. Magnetic Ink Character Recognition (MICR)

1. Bank account number

Account number is the most basic term you will come across in the Indian (or any part of the world) banking system. It is a distinctive series of numbers, which defines and provides access to the owner of the account. This number is unique for every individual who has (or had) a bank account and no two bank accounts can ever have the same account number. It also serves as the information given to people who wish to deposit money into your bank account.

For simple classification purposes, banks use separate starting codes for their branches. Bank account numbers typically comprise 11 to 16 digits in India. The banks of the public sector (such as SBI) follow an 11-digit (5 + 6) sequence for the account numbers. However, all account numbers are shown beginning with 6 zeros on the online SBI site. This makes the account number 17 digits long, which in the modern banking system is the lengthiest.

To read about the best savings account for teenagers, head over to our post: https://gofinanceliterate.com/savings-account-for-teenagers/

2. Bank Passbook

A bank passbook is a book provided by the bank to an individual when he/she opens a bank account with them. Basic information regarding the individual’s account is given in the passbook; such as bank account number, IFS code, MICR code, address details, etc. The passbook also helps the individual to keep record of all the transactions that have taken place from his/her account.

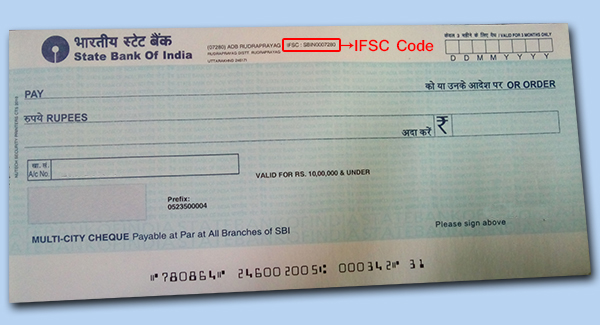

3. Cheque

A cheque is a document that directs a bank to pay a certain sum of money from the account of an individual to another person or company’s account on whose behalf the cheque has been issued. The cheque is used to make payments that are secure, safe, and easy. As hard cash is not involved during the process of transaction, it is a safe choice and minimizes fear of failure or robbery. A cheque-book is given to individuals who sought to have cheques as the preferred method for transactions. A cheque contains vital information such as cheque number, IFSC, and MICR code.

4. Indian Financial System Code (IFSC)

The IFSC is created to assist the movement of electronic funds throughout the nation. It participates in two main transfer modes, NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement). It is an 11-digit alphanumeric code composed of two main elements; the bank code, and the branch code. The first four digits refer to the bank code and the last six digits are the branch code followed by a zero. The IFSC is written on every account holders’ first page of the passbook, and also on the cheque-book. In addition to this, Account holders can also check out the IFS codes of any bank in the country on the official RBI website.

Image Source: https://www.askbankifsccode.com/blog/ifsc-codes-recently-merged-sbi-associates-may-change-soon/

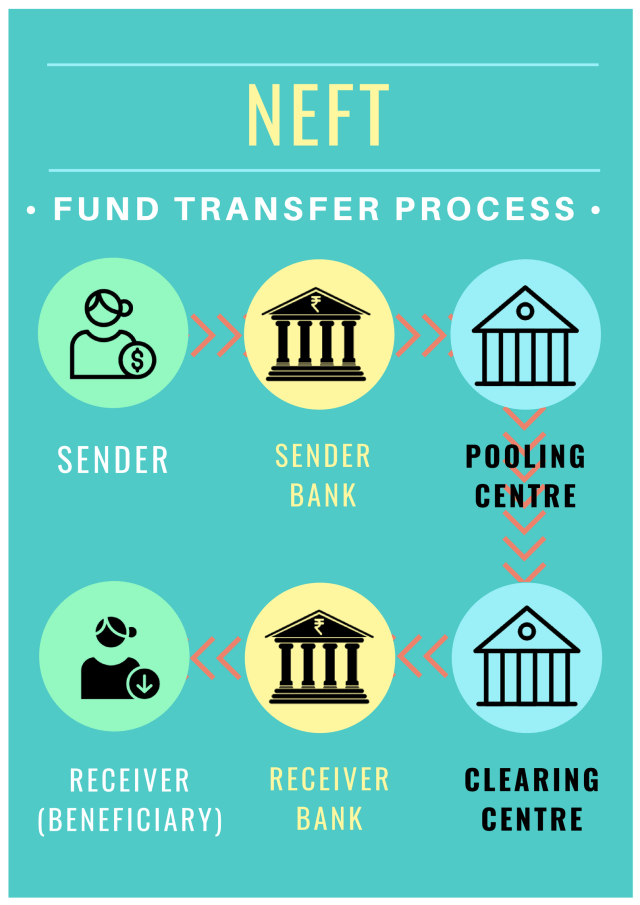

5. National Electronic Funds Transfer (NEFT)

NEFT is an electronic mode that facilitates the transfer of money across the nation from one bank account to another. It has eliminated the need to visit a bank for the transfer of funds as money can be electronically transferred from an individual’s mobile or laptop. The only condition in order to use this facility is that both the sender and the receiver should have bank accounts in a branch that has NEFT facility.

NEFT works 24×7, 365 days a year, round the clock. Also, there is no limit to the amount of money that can be transferred. Timings and settlement periods could be different, depending on each bank. Normally one can expect to receive the money within a couple of seconds if the funds are transferred within accounts of the same bank. However, the transaction time can be longer when such transactions take place between separate banks.

Image Source: https://blog.investyadnya.in/neft/

6. Real Time Gross Settlement (RTGS)

RTGS is an electronic medium to transfer money from one bank account to another on a real-time or gross basis within the nation. The term ‘real time’ implies that the payment is made immediately without any delay and may take approximately 30 minutes from receiving the request, for settlement of funds. The ‘gross settlement’ means the money is transferred on a one-to-one basis.

RTGS transfers are essentially for high-value transactions, and the minimum amount you can transfer via RTGS is ₹2 Lakh. However, there is no upper limit for transferring money through RTGS by visiting the bank branch. Whereas, if you wish to transfer money through RTGS using internet banking; you can only send a maximum of ₹25 Lakh lakh per day.

RTGS money transfer through bank

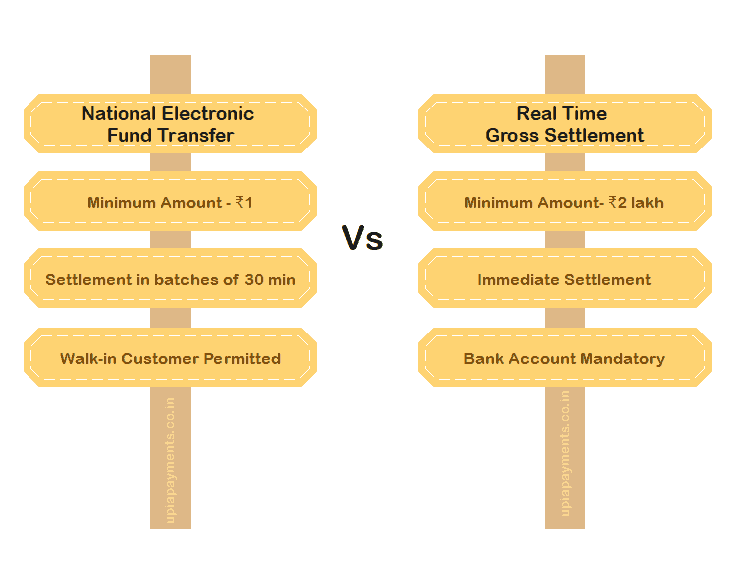

Difference between NEFT and RTGS:

The basic difference between NEFT and RTGS is that NEFT is based on net settlement, while RTGS is based on gross settlement. Net settlement means that the transactions are completed in batches at specific times whereas, gross settlement is where a transaction is completed on a one-to-one basis without clustering it with other transactions.

RTGS transactions involve large sums of money, basically, funds above ₹2 Lakh can be transferred using this method. On the other hand, in case of NEFT, any amount below ₹2 Lakh can be transferred, and this system is generally for smaller value transactions involving less capital.

7. Immediate Payment Service (IMPS)

IMPS is a real-time electronic funds transfer service that credits the transferred money instantly into the receiver’s bank account. It is built on the National Financial Switch network and is managed by the National Payments Corporation of India (NPCI). The service is available to all users round the clock, 24 hours a day, 7 days a week, 365 days a year.

The only requirement to use this service is that the user should have a bank account in a branch that provides mobile and net banking facilities to its customers. In order to send money, users only need to have the recipient’s bank account number and IFSC, and the upper limit for sending money on a day is ₹2 Lakh.

Money transfer through IMPS

8. Unified Payments Interface (UPI)

UPI is a payment interface that allows users to connect more than one bank account to a single mobile application and transfer funds without having to provide an IFS code or account number. The users can send money across the country by only providing Virtual Payment Address (VPA) of the receiver. This has become the most widely used payment interface in India as it is very easy to use and doesn’t require any additional information for sending money.

Many apps have integrated the VPA to be linked with mobile numbers of the users in order to create an even simpler method of transferring funds. Some of the popular apps that use UPI to facilitate money transfer are: BHIM (official app of NPCI), Google Pay, PhonePe, Mobikwik, Paytm, etc.

To learn more about how to receive international payments in India, head over to our post: https://gofinanceliterate.com/receive-international-payments-in-india/

UPI can be used to send money instantly

9. ATM Card

ATM card is a card issued by your bank, which you can use solely for the purpose of withdrawing money from your bank account. ATM Cards are connected to your bank account and use a four-digit PIN or special Personal Identification Number. When you withdraw some money from your account, your bank account balance is reduced in real time. The most inhibiting aspect is, though ATM cards do not charge any interest, you cannot use them everywhere. They have very little use, this means that they are not allowed at large department stores and payment facilities.

10. Debit Card

Debit Card is a card that the bank provides to its customers for the purpose of withdrawing money, transferring money electronically from their bank account when making any kind of purchase, online shopping, etc. To complete the transaction, a four-digit Personal Identification Number (PIN) is required, this is either given by the bank itself or is set by the user according to his/her preference. In addition, you can use debit card for internet banking and mobile banking services. In order to use the debit card, one should have the required amount of money in his/her account.

11. Credit Card

Credit card is a card issued by banks, which lets you borrow funds from a pre-approved limit to pay for your transactions/purchases. The limit is decided by the bank issuing the card based on your credit score and history. Generally, higher the score and better the history, higher is the limit.

The key difference between a credit card and debit card is that when you use a debit card, the money gets deducted from your bank account; whereas, in case of a credit card, the money is taken from your pre-approved limit. However, you need to pay back the amount utilized from your card within a specified period to your issuer, which is generally 20 days. If you fail to do so, the issuer shall levy an interest that will continue to compound until your payment is due.

12. Loan

A loan is when you collect finance from a bank, a friend, or a financial institution that has the guarantee that it will be repaid in the future along with the principal as well as the interest. The principal is the amount lent, and the interest is the fee on the recovery of the loan. Considering that the lenders take the risk of giving you a credit service and fear that you will not be in a position to repay the same amount, they must cover the risks by charging the amount in the form of interest. There are various types of loans depending on your need; Personal loan, home loan, car loan, gold loan, educational loan, etc.

13. Interest

Interest is measured as a percentage of the amount of the loan paid periodically to the lender for the benefit of using their capital. The amount is generally quoted as an annual rate, but interest may be measured over terms longer or shorter than one year. Interests are generally of two types; simple interest and compound interest. Simple interest is the interest calculated on the principal of a loan or the original amount given; whereas, compound interest is the interest earned on capital that was previously earned as interest. This cycle is similar to the snowball effect and can act as a means of exponential growth.

14. Collateral

Collateral is any form of valued asset that the lender gives in return for a loan to a bank such as real estate, gold or securities. Collateral is used in secure loans and is lucrative for all bank lendings. The bank will simply sell or bid out the collateral in the event when the debtor fails to pay his/her loan. It acts as an evidence that an individual has the ability to repay the loan and also leads to ensuring that the debtor fulfils the financial requirements.

15. Magnetic Ink Character Recognition (MICR)

MICR code is a code found in cheque-books and passbooks of account holders. It contains a 9-digit serial number where, the first three digits represent the city, the next three, the bank, and the last three digits represent the branch. RBI introduced this code to quickly and efficiently facilitate NEFT transactions. Since the MICR code contains a special magnetic ink, fraud cases can easily be detected with the help of a magnetic scanner.